With cumulative investments worth more than 1.6 billion USD in 2013

The Gulf Organization for Industrial Consulting (GOIC) revealed that the number of firms manufacturing bottled water has increased from 106 businesses in 2003 to 183 in 2013. In parallel, the cumulative investments of this sector jumped from 446 million USD in 2003 to 1.6 billion USD in 2013. These figures highlight the extent of new projects that were established throughout the relatively short period of time in order to fulfil the increasing demand for bottled drinking water. In the book, GOIC highlights the increasing labour force in this sector from 10000 to 25600 workers during the same period of time, while the design capacities of various bottled water factories have augmented from nearly 7.5 billion litres in 2003 to almost 15.3 billion litres in 2013.

GOIC Secretary General Mr. Abdulaziz Bin Hamad Al-Ageel stated that the Organization has decided to publish the “Industry and Trade of Bottled Drinking Water in the Gulf” in the last quarter of 2014 as part of its specialised issues. The objective of this book is to shed light on this sector which achieved remarkable successes recently. These successes have been driven by the increasing demand for bottled water, a natural result of the demographic boom, the growing health awareness and the increasing needs of restaurants, hotels, public facilities and tourism. According to Al-Ageel, this book contributes in spreading industrial and economic knowledge and allowing decision makers and stakeholders in the socio-economic development sector to have access to valuable data in GCC countries. “Bottled water is a vital manufacturing industry since it guarantees drinking water, one of the most crucial necessities for human life. It is also an important pillar of food security in the GCC region where natural water is scarce”, said GOIC Secretary General.

The book provides an overview of the current situation of the sector and the characteristics of healthy drinking water in accordance with Gulf benchmarks such as using pure water from an unpolluted source in factories that are far from pollution triggers. Furthermore, it highlights natural characteristics of colour and turbidity in accordance with international standards in addition to acceptable taste and smell. As to chemical characteristics, they determine the proportion of mineral elements (nitrates, arsenic, barium, cadmium, lead, cyanide, selenium, silver, mercury, chloride, copper, iron, calcium, magnesium, manganese, phenols, sulfates, zinc) in accordance with international standards. It also determines the percentage of total dissolved solids and in the case of water treatment with chlorine etc., and radiative, biological and microbiological characteristics and sterilization. The water should be completely free of insects and all microorganisms and microbial pathogenesis.

The book is composed of five chapters. The first is a diagnosis of the technical, heath and economic aspects of bottled drinking water, an overview of health specifications and requirements of the bottled drinking water industry and the various manufacturing phases. Chapter two diagnoses and analyses the current situation of the drinking water industry in GCC countries in terms of the number of factories, their distribution per country, the size of their cumulative investments, the number of workers, the size of their design capacity and production estimates throughout the last seven years. The third chapter analyses foreign trade of bottled drinking water including imports, exports and net imports. Chapter four tackles the present apparent consumption of bottled drinking water and consumption projections till 2020, the demand gap in every country per year and the required effort to fulfil the need. As to the fifth chapter, it diagnoses and analyses the manufacture of bottled drinking water in every GCC country.

Diagnosis of this industry in the Gulf

According to GOIC’s figures, there were nearly 183 bottled drinking water factories in GCC countries in 2013 and almost 85% of them manufacture drinking water exclusively, while almost 15% manufacture bottled water as a secondary product in addition to refreshments. Saudi Arabia hosts nearly 52.5% of these factories, the UAE 22.4%, Oman 9.8%, Bahrain 6.6%, Qatar 5.5% and Kuwait 3.3%.

The cumulative investments of this sector in GCC countries were more than 1.6 billion USD in 2013, with an average of 8.83 million USD per factory. In this regard, 79.2% of these investments were in Saudi Arabia, where factories are enormous in terms of size, followed by the UAE (11.9%), while all other GCC countries combined contributed with approximately 9% only.

The bottled drinking water sector in GCC countries offered jobs to approximately 25600 workers in 2013, with an average of 140 workers per factory divided as follows: KSA 70%, UAE 18% and all other GCC countries combined 12% of the labour force.

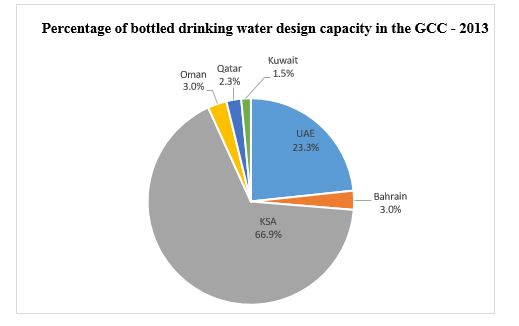

Design capacities of bottled drinking water factories in GCC countries were almost 15.3 billion litres in 2013 divided as follows: KSA 67%, UAE 23.3% and all other GCC countries combined 10% only. As to the production estimates in GCC countries in 2013, they were worth 14.4 billion litres. Countries’ contributions to production was very close to the size of their design capacity.

Structure of the bottled drinking water industry in GCC countries in 2013

| Country | Number of Factories | Cumulative investments (million USD) | Number of workers | Design capacity estimates (million litres) | Production estimates (million litres) |

| UAE | 41 | 192.0 | 4605 | 3566 | 3280 |

| Bahrain | 12 | 26.4 | 954 | 455 | 364 |

| KSA | 96 | 1,280 | 17890 | 10,232 | 9,785 |

| Oman | 18 | 43.9 | 930 | 455 | 397 |

| Qatar | 10 | 38.0 | 821 | 354 | 340 |

| Kuwait | 6 | 35.9 | 365 | 229 | 222 |

| TOTAL GCC | 183 | 1,616.2 | 25565 | 15,291 | 14,388 |

Source: The Gulf Organization for Industrial Consulting (GOIC)

Bottled drinking water foreign trade

Imports

GCC countries managed to cover most of their needs in terms of bottled drinking water through local production. Thus, their bottled water imports, notably mineral water with special tastes, are moderate. Furthermore, bottled water trade between GCC countries is important, however countries’ imports from within the GCC have declined since KSA decided to stop exporting drinking water in 2012. Consequently, GCC drinking water imports declined from 477 million litres in 2008 to 414.6 million litres in 2012; 71% of imports are from countries outside the GCC region such as France. The UAE and Kuwait are the biggest importers, followed by Qatar, Oman, Bahrain and then Saudi Arabia.

Exports

GCC bottled drinking water exports declined because of the Saudi decision to stop exporting from nearly 447 million litres in 2008 to approximately 194 million litres in 2012. The UAE is now the leading exporter with a percentage of 58% of the total GCC exports, while the exports of all other GCC countries combined are 42%.

The apparent consumption of bottled drinking water

GCC countries consume large quantities of bottled drinking water estimated at nearly 14.1 billion litres in 2013. KSA is the biggest consumer with a percentage of 65% of the total GCC consumption, followed by the UAE (23.2%), which means that the total consumption of KSA and UAE combined is more than 88% of the GCC bottled water consumption. The remaining GCC countries combined share less than 12% of the total consumption.

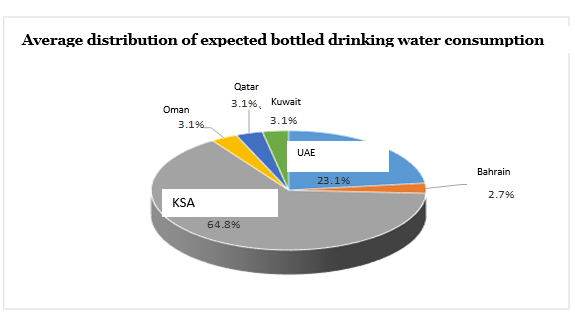

Bottled drinking water consumption is expected to increase in GCC countries with an annual average of 6% to 7%, hence increasing their expected apparent consumption to almost 21.3 billion USD in 2020. Therefore, they need additional quantities of water by 2020 (more than 7.2 billion litres). The Kingdom Saudi Arabia has the biggest demand gap among GCC countries (64.1%), followed by the UAE (approximately 22.8%) and then other GCC countries with smaller demand gaps.

Apparent consumption estimates in 2020 and demand gaps

| Country | Estimated consumption (2013) | Expected consumption (2020) | Estimated demand gap (2020) |

| UAE | 3,269 | 4,915 | 1,646 |

| Bahrain | 394 | 583 | 189 |

| KSA | 9,155 | 13,780 | 4,625 |

| Oman | 415 | 669 | 254 |

| Qatar | 386 | 670 | 284 |

| Kuwait | 435 | 654 | 219 |

| TOTAL GCC countries | 14,054 | 21,271 | 7,217 |

Source: The Gulf Organization for Industrial Consulting (GOIC)