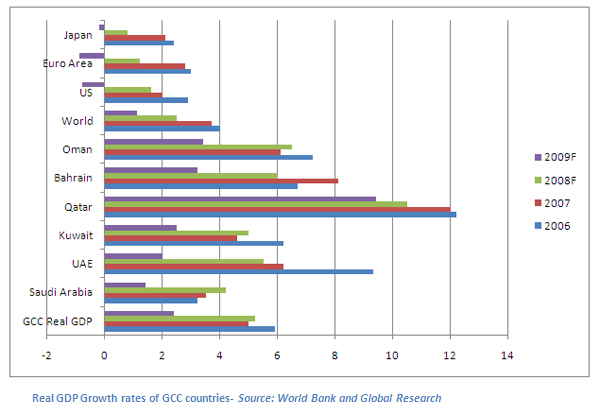

Economic Background In 2009 the combined economies of the GCC countries will witness a real growth rate of 2.4%, despite the world economic crisis and the fall of oil prices, according to Global Investment House. Among the GCC peers, Qatar is likely to remain insulated with a staggering 9.4% real GDP growth rate in 2009, according to World Bank reports.

The GCC countries have accumulated huge financial surpluses during the past years, when prices of oil reached record highs. Furthermore, the financials crisis is prompting many investors to turn away from real estate and stock markets and invest rather in industry. In the Middle East, $79bn of investments in petrochemicals is planned for the 2007- 11 period, according to KPMG. Abu Dhabi is building a $20bn chemicals city called Chemaweyaat, and Saudi Arabia plans a $26bn refinery and petrochemical complex at Ras Tanura. Both states, along with Qatar, have identified the industry as an integral component in diversifying their economies and creating jobs, confirms Financial Times. A further 53 new plants are due to come online in the Middle East by 2012, and the regional industry will grow nearly 10% a year until 2020, more than twice the average, according to KPMG. The Gulf focuses mostly on basic petrochemicals such as ethylene, poly-olefins, polypropylene, but will soon be able to produce a wider array of chemical products. It is already a leading manufacturer of fertilizers.

|

© Copyrights reserved 2009. Gulf Organization for Industrial Consulting (GOIC), Doha, Qatar. |

HOME |

|MEDIA

CENTER |

SITEMAP |

CONTACT US | ARABIC |